Dear Friends, Colleagues and Clients:

Update on Farrell Advisory: Beating the COVID Challenge

I hope this letter finds you well and safe with your family. As we enter the third quarter of 2020, we would like to provide a brief overview of the year thus far, guidance for the road ahead, and update you on what we have been working on at Farrell Advisory.

What has Farrell Advisory Been Doing?

It has been in fact a very busy time for us, be it managing sell-side engagements or reevaluating buy-side transactions. We have been taking offensive action, rather than being purely defensive, in helping our clients reevaluate their business models and improve efficiency. We are doing this, not just by reducing their cost base, but also by improving how we manage, monitor and forecast their business so that our clients can proactively react with much more precision and speed to lenders, new customer requirements (volume or new solutions), or changing dynamics and adapting to the remote workforce (see Appendix C).

The First Half of 2020: COVID-19 & Market Backdrop

No one could have anticipated the speed and magnitude of the damage that COVID-19 has inflicted. On February 19, 2020, the S&P 500 reached a record high and the global economy seemed well positioned for growth. Just one month later, the COVID-19 outbreak triggered market instability and brought with it a period of economic uncertainty as nations enacted quarantine regulations. US-based companies have accumulated $10.5T of debt through the first quarter of 2020, the largest sum generated since the Federal Reserve Bank of St. Louis started tracking this figure after World War II. The U.S. economy shrank 9.5% from April through June, the largest quarterly decline since the government began publishing data 70 years ago, and GDP shrank at an annual rate of 32.9%, according to the Bureau of Economic Analysis. The S&P 500 suffered a 34% peak-to-trough drawdown to its March 23rd low in the fastest bear market in history, but has since rallied 45%, leaving it just up 1% for the year.

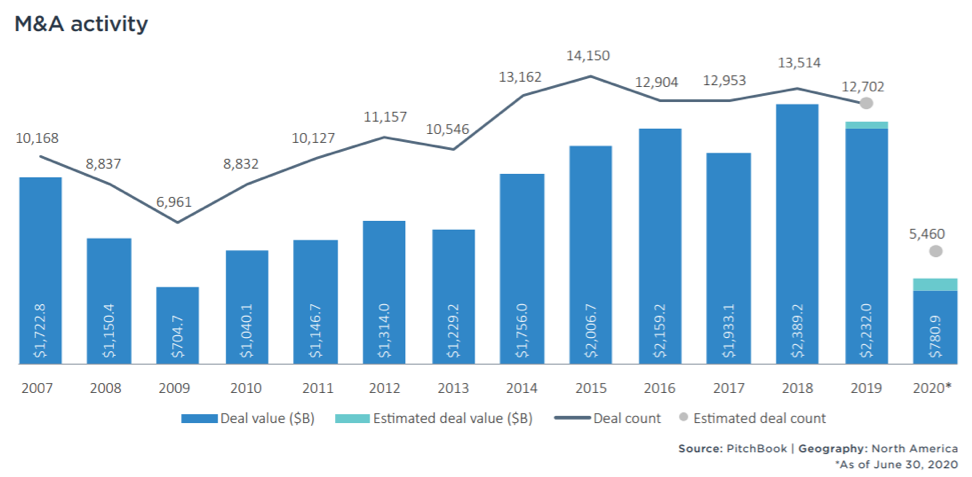

We delve deeper into middle market M&A activity at Appendix A, but in summary, the market has changed. While financial acquisitions are either on hold or being re-valued, strategic acquisition activity continues to hold relevance and value to acquirers. For example, Lululemon is set to acquire home fitness startup Mirror for $500M. Lululemon is known to most as a high-end fitness apparel company, while Mirror, launched in 2018, sells an interactive mirror that can stream live and on-demand workout classes. Lululemon’s acquisition of Mirror is a good example of an “out-of-the box” strategic acquisition that will offer value in these times and beyond.

However, with so many moving parts, the future remains ambiguous. As of July 11, 2020, jobless claims have reached over 16.2 million (for comparison, 8.7 million jobs were lost during the previous global financial crisis). In June, the National Bureau of Economic Research announced that the US officially entered a recession back in February. Additionally, the U.S. now has 4.38 million confirmed cases and 150,000 deaths related to COVID and numbers are now rising quicker, especially in states such as Florida, Texas, and California as certain businesses and public spaces have reopened—a frightening thought especially considering we had the opportunity to learn from other countries’ mistakes.

The Road Ahead

Echoing Warren Buffett, we should never bet against America. Our country—and the world—will heal, and deal markets are no different. It will just take time. No one can predict with high conviction what lies ahead in terms of how the pandemic will play out and what the long-term economic impact will be. The U.S. market will be influenced by largely uncontrollable factors such as vaccine development, civil unrest over racial inequality, and the upcoming presidential election. We, and investors in particular, tend to crave certainty, but there is tremendous unpredictability about the election outcomes for both the White House and Congress given the unreliability of polls, as well as what exact policies would be enacted and when. Of the 1,106 national polls in the year leading up to the 2016 Presidential election, only 71 showed Trump ahead at any point during the year. The outcome of the 2020 election will likely be similarly difficult to predict and unreasonable to try to control.

However, there are things that we can control and these we should focus on. At Farrell Advisory, we are not new to managing unpredictable situations, and the work that we have done in the last 6 months as well as during previous financial crises is replicable to other companies. Farrell Advisory remains engaged and dedicated to working with our clients to help them get through these challenging times and come out stronger.

Farrell Advisory is committed to not letting 2020 go to waste for its clients.

We believe that the ability to efficiently operate a business while also preparing for rapid adaptations matters more so now than ever before. Survival should not be the only goal—we want your company to be able to come out of this crisis stronger and nimbler than before, ready to face the unexpected and remain resilient against black swans like the COVID pandemic. Here is an example of a white paper found on our website discussing how warning signs of distressed situations can be used as a catalyst for positive changes to create shareholder value in companies if identified quickly, managed properly, and before formal restructuring negotiations are started.

How to Optimize Your Business During This Crisis

As the coronavirus continues to disrupt activity across the business landscape, companies that were otherwise healthy may find themselves facing challenges. It is paramount that companies remain transparent with their stakeholders with detailed assessments, including accurate short-term (i.e., 13-week cash flows) and medium-term forecasts. While this is a time of hardship, crisis and uncertainty can breed opportunity. We urge you not to waste the opportunities that this global recession has brought. Do not wait until 2021 to reflect and act, and consider taking an offensive position (i.e., getting better prices, better quality, better services) rather than only playing defense (i.e., just cutting costs).

With so many things going on, what are some steps you can take to optimize your business?

Short to Medium Term (through to December 2020)

- Realign your business model offensively (i.e., by perform a Zero-Based Budget exercise).

- Improve communication and management of the remote work force by implementing a clear remote work policy. This should outline, for example, when employees are expected to be online or available and which communication channels to use (e.g., email, Slack, Zoom).

- Ask employees what they need to enable them to work more efficiently.

- Proactively and transparently communicate with employees, customers, vendors, lenders, and other stakeholders.

- Review the fiduciary duties of corporate directors (refer to Appendix B).

- Conduct triage and crisis management. You can find more about how Farrell Advisory approaches crisis management as well as additional details about how we can help here.

- In summary, the four main elements of crisis management are:

- Transparent (Board) Leadership;

- Stabilization Actions;

- Planning (Asking and Doing); and

- Efficient Execution.

- Securing and maintaining liquidity are essential parts of crisis management. An increased focus should be placed on liquidity and monitoring cash burn.

- Many of the companies that shut down in mid-March still had about 60 days of invoices due and may have received PPP money. Now, months later, they have no more invoices left to collect and may have to consider consolidation or other options.

- Company executives need to micromanage cash. They cannot let their guard down until a vaccine is found for the coronavirus.

- Implement new strategic and budgetary plans, operating and organization models, and key performance monitors.

- Identify where current business processes could be improved and the potential savings.

- Review and analyze the current debt/equity structure, potential future cash flows, and financing requirements.

- In summary, the four main elements of crisis management are:

Long Term

- A crisis can be a good time to “reset” or rebuild a business strategy for the long-term.

- Understand what customers will value, post-COVID-19, and develop new use cases and tailored experiences based on those insights and focus on high value sales.

- Review your cost base and vendors. Think about how your operations and supply chains can be improved to protect against future shocks. Appendix D contains more information on supply chain strategy.

Developing Resilience Against Disaster Scenarios

- Companies should prepare for worst case scenarios, including an extended lock down, and develop a set of measures which can be implemented at short notice.

- Reduce in-person meetings and travel if possible. If employees get sick because of work related travel or meetings, a business could face liability issues and will have to manage requests for sick leave and generally lower employee morale and effectiveness.

- Be adaptable and tactical. Making strategic plans is important but understand that these plans will need to be refined at a later date. Do not put your company in a position where it cannot be flexible: “If a decision is reversible, we can make it fast and without perfect information. If a decision is irreversible, we had better slow down the decision-making process and ensure that we consider ample information and understand the problem as thoroughly as we can.” (Farnam Street).

Other Things to Keep in Mind

Disruptions to business because of COVID-19 are forcing many companies across a wide range of industries to draw on their revolving credit facilities to increase the size of their normal liquidity due to the difficulties in forecasting. As these companies strategize, it is important for them to understand the terms of their credit facilities, including banking covenants and the ability to increase their lending facility. The ability to forecast bank covenants will become even more important as potential breaches of banking covenants become more prevalent in the next and following quarters as borrowers generate lower revenues with the inability to reduce costs sufficiently.

It is paramount that business owners understand the importance of cash flow—Cash flow is King, more so now than ever before. Lack of cash is one of the biggest reason’s businesses fail, so it is even more important that business owners understand the importance of working capital management

Call to Action

No one can predict with high conviction what lies ahead in terms of how the pandemic will play out and what the long-term economic impact will be. Goldman Sachs forecasts that S&P 500 companies will fall 25% in 2020, and then rebound by about 40% in 2021. No matter what the broader economic environment may look like now and in the future, Farrell Advisory remains dedicated to reliably serving our clients through providing corporate finance services and helping deliver shareholder value. We can bring a wealth of experience, technical expertise, and independence to meet the needs of your company.

We welcome opportunities for us to collaborate to achieve your organizational goals, and we would greatly appreciate it if you could forward this letter on to any others who may benefit from the information or services we offer.

We look forward to hearing from you.

Best regards

David Farrell

Appendix A: 2020 Q1 Middle Market M&A Review & H1 US PE Breakdown

Because of COVID-19, it is now much more important to look at year-to-date 2020 performance by quarters rather than only looking at the first half of 2020. Q2 of 2020 was the first full quarter reflecting the effects of the COVID-19 pandemic, and the slowdown in U.S. PE deal activity became more apparent.

Q1-2020 Middle Market M&A

In Q1-2020, middle market deal flow remained steady despite the influence of the COVID-19 pandemic. This was likely because most of the deals in this quarter were negotiated pre-pandemic. According to Pitchbook, General Partners (“GPs”) closed on 885 deals for a value of $150.8 billion, gains of 14.2% and 31.3% Y-o-Y, respectively. Dissected further, the lower middle market (“LMM”) and core middle market (“CMM”) showed quarter over quarter (“QoQ”) gains in deal value due to greater resiliency, as they are generally less sensitive to the fluctuations of the larger market since many transactions are due to sellers’ personal reasons. Deals in the LMM and CMM posted declines.

The middle market is generally more resilient than the public markets, and valuations are more stable. Although closing rates have declined as deals get cancelled or postponed, the market is still active and M&A deals are getting executed. Because middle market volume is largely driven by events such as ownership transitions and the need to scale, activity in this sector is not as impacted by systemic shocks. Additionally, private equity firms have large amounts of cash to invest, with capital reserves of around $1.2 trillion, according to Capstone Headwaters. Potential distressed investments have also expanded recently as the pandemic brought financial hardship to many companies—according to Pitchbook data, “globally, firms have raised $16 billion across 10 distressed debt and special situations funds so far this year”.

Q2 North American M&A

M&A activity continued to decline in Q2, with a total of 2,025 deals closed for a value of $336.8 billion, YoY declines of 33.1% and 26.7%, respectively. These figures are slightly misleading, as Q2 in general was a relatively weak quarter for M&A activity. Q2 resulted in QoQ declines of 41.1% and 24.2% for deal value and count, respectively, compared to an already weak Q1 2020. Prospects for the US M&A market are particularly bleak. Many of the states that had opened up recently saw spikes in cases and shortly afterward shut back down. The International Monetary Fund forecasts an 8% decline in GDP for the US in 2020.

Nevertheless, while frail companies are completing deals just to survive, certain sectors such as tech and healthcare continue to see stable deal making. Companies in these industries have generally benefited from COVID-19 side effects and have been opportunistically seeking out M&A transactions. With so many Americans working from home, technology is more critical than ever, and this is reflected in the M&A market with the top six deals of Q2 all coming from the tech sector.

Q2 2020 PE Market and Trends

Q2 of 2020 was the first full quarter reflecting the effects of the COVID-19 pandemic, and the slowdown in US PE deal activity became more apparent. There was a 20% decline in deal value in the first half of 2020 compared to the first half of 2019, with closed deals totaling $326.7 billion in 2020. PE deals further declined in Q2 of 2020 as the deeper impacts of the COVID-19 pandemic were felt. Some GPs invoked the material adverse change (“MAC”) clause to pull out of previously agreed upon deals. There have been more lawsuits over MAC clauses since April 1, 2020, than in the past 10 years combined. Exit activity in Q2 has also collapsed as instead of selling, PE firms are choosing to mark down portfolio companies and hold their investments, with many conducting triages and determining which of their companies to save and how. Announced global PE exits were down by about 70% in May 2020 compared to May 2019. Pitchbook predicts that PE holding times will expand similarly to what was seen during the global financial crisis.

Because many of the traditional sources of deal flow have dried up, PE firms have been getting creative with their deal making. Pitchbook anticipates that GPs will continue to pour investments into the technology sector, which has proven to be recession resistant and is the most represented sector in terms of minority transactions. During H1 of 2020, slightly under 20% of all PE deals have been in the technology industry, and they represent a little over 30% of PE deal value. Competition for technology companies is likely to remain intense as their valuations have held up better than other sectors.

The Vulnerability of Large Debt Loads

Large debt loads and the coronavirus have forced several portfolio companies into bankruptcy, and this trend seems likely to continue as credit rating agencies recently downgraded hundreds of PE backed companies. There have been several high-profile bankruptcies of PE-backed companies in 2020 so far, particularly in the retail space with J. Crew, Nieman Marcus, 24 Hour Fitness, and John Varvatos all filing for bankruptcy in the past few months. The large debt loads associated with LBOs have weighed down many retail companies, and PE-backed retailers appear to be in worse positions than non-PE backed companies. More than 70% of the 38 retailers with the weakest credit profiles were PE-backed as of April 20, and the market has taken note, with retail buyouts decreasing in recent years. Through the first half of this year, the number of PE-backed companies in the consumer space alone that have filed for bankruptcy totaled 57. In contrast, PE-backed bankruptcies reached a multiyear low of 215 in 2019 across all industries worldwide.

Changes in M&A Strategy

SBA data shows that over 8,000 PE- and VC-backed companies got access to as much as $13.4 billion in Paycheck Protection Program (“PPP”) loans. However, several companies deny that they took out a loan, which casts a degree of doubt on the accuracy of the data and private equity backed portfolio companies are predicted by many to face a tough remainder of the 2020 year.

This outlook has prompted GPs to move to minority deals (i.e., growth equity and private investment in public equities (“PIPEs”) to utilize their capital in today’s environment. Of the deals completed in Q2, a higher proportion were add-ons and, on average, smaller than platform deals. Add-ons made up the highest percentage of LBOs on record and median deal size declined for the first time in five years. Equity contributions from GPs when acquiring assets are forecast by Pitchbook to increase, while overall EBITDA multiples are anticipated to fall. According to FactSet, US private equity activity increased in May, up 37% from April even though aggregate transaction value decreased from $8.9 billion to $6.6 billion. Capstone Headwaters anticipates declines in the deal-making industry as inventory is rebuilt in Q3 of 2020, but predicts that a new wave of deals will arrive by Q4, in addition to activity from end-of-life PE investments, restructurings, and distressed M&A. They believe emphasis will be placed on deal structure and due diligence as companies assess their financial resilience.

Appendix B: The Effects of Financial Distress on Fiduciary Duties

Many corporate borrowers are struggling to meet their debt obligations as a result of the financial stress inflicted by the COVID-19 pandemic, and creditors may try to hold corporate officers and directors accountable. It would be prudent for companies to review the fiduciary duties of corporate directors and officers and the effects that financial distress could inflict on those duties. Directors’ and officers’ fiduciary duties include Duty of Care and Duty of Loyalty. These require fiduciaries to exercise carefulness and prudence and act not in self-interest but in the best interest of the company.

Financial Distress

The solvency of a company is one form of financial distress. There are three tests that are commonly used to determine the solvency or insolvency of a company:

- A balance sheet test, where a business in insolvent when its liabilities exceed the market value of its assets.

- A cash flow test, where a business is deemed insolvent when it cannot pay its debts.

- A capital adequacy test, where a business is insolvent when it does not have enough capital to meet its operating expenses, capital expenditure requirements, and debt repayment obligations.

Impact of Solvency on the Fiduciary Duties of Directors and Officers

Claims related to the fiduciary duties owed by the officers and directors are generally made available to creditors when a company becomes insolvent. In the case of insolvency, creditors are allowed to assert derivative breach of fiduciary duty claims (although they never have direct standing to sue for breach of fiduciary duties, and in states like Delaware, courts have ruled that “deploying fiduciary duties to protect creditors should be a final resort, not a first response”). Directors and officers can use their businesses judgment to take calculated risks to pursue value-maximizing strategies in distressed situations.

Appendix C: Remote Workforce

The move to a remote workforce has been a big change for both employees and leadership, and after many months of being apart and lacking face-to-face social interactions, various challenges are arising, including “Zoom fatigue”. The key questions management should now be asking are (1) how does our business create and maintain relationships (i.e., with employees, vendors, and (new) customers) without meeting them in person? Does speaking over video now mean you have “met” the person? How do you maintain creativity and interaction (i.e., data flow and informal exchange of ideas) without people being in the same room?

In the past, companies such as IBM and Best Buy that have tried remote work have stopped the experiments after finding that telecommuting diminishes accountability and creativity. However, some companies such as Google and Twitter are excited about the long-term prospect of remote workforce (overhead costs are cut without the need for offices) and in turn employees avoid the need to commute to work. Google will now let employees work from home until at least July 2021, while Twitter will allow staff to permanently work from home. Perhaps this time around it will be different because of (i) better technologies that help us stay in touch and (ii) because we are more aware of the softer skills required from managers to make remote working successful for both employees and employers. There nonetheless remains hurdles with remote work that need to be overcome. Management must find ways to keep employees engaged now that they are working from home, often in more distracting environments where focus can be harder to find. Employees themselves must do the same and find ways to stay productive.

While in-person discussions will not be fully replaced, we will likely see an evolution in the way that due diligence processes are conducted, with more virtual discussions, requests for digital content earlier in deal processes, much better data analytics (particularly understanding cost spend and customer/service activity), and more background checks to support verbal representations. Acceptance of the changes in due diligence approach may be one of the many reasons for the delay in completing an M&A or financing transaction; however, the major reasons for the delays are due to (i) buyers delaying the deal to see (rather than forecast) what the new norm may look like; (ii) tighter restrictions and availability of finance; and (iii) because management had been so focused on the repositioning of their operations and cash flow management. We highly recommend, through better project management, that the length of completing transactions not be materially extended, as the extension can tire and divert management time away from managing their business and thus expose shareholders to unnecessary risks. At some point, you have to say, “that’s enough, let’s move on”.

Appendix D: Supply Chain Strategy

Background

The United States, along with other advanced industrial economies, has developed over its history a highly efficient product and delivery system that allows a wide variety of products to be moved at relatively low costs. However, the COVID-19 pandemic has challenged and highlighted the dependencies and weaknesses of this system. In the past few decades, there has been a major manufacturing shift to countries in Asia, driven by the desire to achieve lower labor costs. Companies with supply chains originating in or heavily dependent upon operations in China have been the most adversely impacted and will continue to face production, inventory, and logistics challenges. As businesses reevaluate their supply chain operating models, it will be helpful to utilize a three-pronged strategy to address (1) supply chain cost; (2) agility; and (3) risk resilience.

Supply Chain Cost

As companies leverage low-cost manufacturing labor overseas, their supply chains have grown increasingly complex and concentrated in certain regions. As low-cost countries become more affluent, the cost advantage gained by outsourcing manufacturing overseas is reduced. Additionally, overseas manufacturing requires additional embedded costs such as planning coordination, capital tied in inventory, warehouse management, and product development, all of which lower the cost advantage. As the coronavirus pushes companies to rethink their supply chains, they may want to consider gradually transitioning manufacturing functions to other locations, including the United States, to reduce the geopolitical risk and prepare for unforeseeable disruptions in the future.

Agility

End-to-end supply chains response times have slowed down as businesses try to take advantage of the labor arbitrage provided by low-cost countries. The longer the time lag between demand and supply, the less agile a company is when reacting to changes in demand and supply. Companies that began shifting their production from China last year have been better prepared to deal with COVID-19 related disruptions. To increase the agility of their supply chains, businesses should consider other options (i.e. manufacturing in India, Mexico, of the United States) based on cost benefit analysis and weighing the ability to swiftly react to future supply chain disruptions. Apple, for example, announced earlier this year that it was moving 20% of its iPhone production out of China in favor of India, where favorable factors include an English speaking workforce, highly skilled labor, low cost labor, and a domestic market of 1.3 billion people whose disposable income is growing.

Risk Resilience Both the coronavirus pandemic and recent geopolitical trade wars have brought the risk of international supply chains into focus, galvanizing companies to reformulate their supply chain strategies. While all foreign countries pose a degree of risk, the infringement of technology is less prevalent in most countries as in China. US businesses can strengthen their supply chains by using a phased approach to shift them to countries with lower geopolitical risk profiles. The immediate priority should be to move operations from China so that the overall business is less prone to being disrupted by trade wars or other political conflicts. In the longer term, companies should utilize new technologies to design low-cost, automated processes in the United States to increase labor productivity at home. This will reduce the dependency on other countries and strengthen the overall resilience of their supply chains.

Co-authored by David Farrell and Emma Liu.

Background on Farrell Advisory Inc.

Farrell Advisory Inc. provides highly customized Corporate Finance services to business owners, boards of private equity firms, corporations and banks with regards to promptly and efficiently helping companies deliver shareholder value through:

- Chief Financial Officer and Restructuring & Business Reengineering solutions offerings for companies who are not operating optimally or in a stressed environment.

- M&A/Refinancing Transactions ((a) Buy-Side: formal buy-side due diligence, inhouse corporate development function and M&A disputes; (b) Sell-Side: pre-investment diagnostic, maximization of valuation by advanced preparation and implementation, carve-outs and M&A disputes; and (c) Merger Integration and Growth Initiatives).

David Farrell has over twenty years of experience in Reengineering/Restructuring and Transaction Advisory Services (buy-side and sell-side due diligence, carve-outs) either as a consultant (Partner and Managing Director) at Big 4 (KPMG), international consulting practices (FTI Consulting, Farrell Advisory) and national accounting firms (Cherry Bekaert, a Baker Tilly network firm) or as principal (CFO or Strategic roles) at European listed businesses, covering both the strategic as well as the transactional side of the business, with deep knowledge of the U.S., European and emerging markets. Mr. Farrell earned a B.Sc. in Economics and Accountancy from Loughborough University in the United Kingdom. He is a Chartered Accountant (“ACA”) in England and Wales and has obtained the Corporate Finance (“CF”) qualification from the Institute of Chartered Accountants in England and Wales (“ICAEW”).

Emma Liu is an intern at Farrell Advisory and an undergraduate student at the University of Maryland pursuing degrees in Finance and Accounting.

Disclaimer

This document contains general information, may be based on authorities that are subject to change, and is not a substitute for professional advice or services. This document does not constitute tax, consulting, accounting, investment, legal or other professional advice, and you should consult a qualified professional advisor before taking any action based on the information herein. Farrell Advisory Inc is not responsible for any loss resulting from or relating to reliance on this document by any person.